New York State Senator James Sanders Jr. and Assemblymember Phil Steck will join activists from the Corporate Campaign, New York State Council of Churches, the New Economy Project, and other advocacy organizations for a press conference urging New York State to reinstate the Stock Transfer Tax.

The press conference will be held on Wednesday April 23 at 12 noon in from of the New York Stock Exchange at 11 Wall Street in New York City.

Originally enacted in 1905, the Stock Transfer Tax was a modest half-penny levy on stock trades. However, it was repealed in 1981, resulting in an estimated loss of $13 billion to $17 billion in annual revenue for the state.

In a statement announcing the rally, the groups said that “with the looming threat of reduced federal funding, it is more critical than ever for New York to explore sustainable revenue sources.” Reinstating the Stock Transfer Tax would provide much-needed funding for various programs, including: health care, education, transportation, MTA, CHIPS, affordable housing, NYCHA, environmental/climate change, renewable energy, and municipal aid.

From 1905 to 1981, New York State collected a tiny one-tenth of one percent tax called the stock transfer tax on the sale of corporate stocks.

But since 1981, New York state began giving back one hundred percent of these tax revenues, estimated to be $14 billion annually or $56 million per trading day.

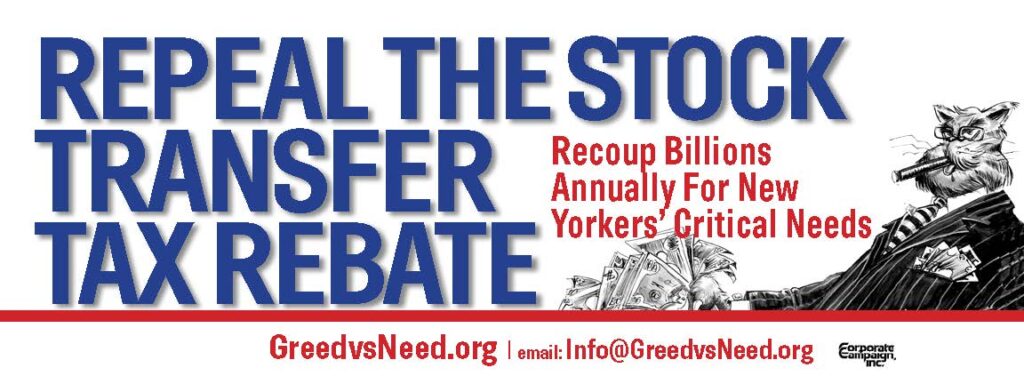

Corporate Campaign, one of the organizers of the rally, is focused on the campaign to repeal the stock transfer tax rebate.

Corporate Campaign’s Ray Rogers has organized a greed versus need campaign to repeal the rebate.

“While infrastructures throughout New York State are crumbling, homelessness is rising, and critical public services for healthcare, housing, education, transportation, and public safety are grossly underfunded or non-existent, the message emanating from the offices of New York’s Governor Kathy Hochul, Assembly Speaker Carl Heastie and Senate Majority Leader Andrea Stewart-Cousins is ‘Now is not the right time,’” Rogers says.

“Maybe now is not the right time for them but most certainly it’s the ‘right time’ for millions of suffering New Yorkers. In fact, it’s long past time to repeal the stock transfer tax rebate and return billions of dollars to the state treasury. Common sense, compassion and fiscal responsibility demand nothing less.”

“The billions and billions of dollars that we should have been collecting since 1981 could have done a lot of good,” Rogers says. “We wouldn’t have bridges falling apart, we wouldn’t have affordable housing falling apart, we would have much more money for front line workers in healthcare and education. You name it.”

“The opposition against the rebate are the big institutions that represent some of the largest, most powerful corporations here in New York. The Citizens Budget Commission, the Partnership for New York City, the Securities Industry and Financial Markets Association (SIFMA) – they all vehemently oppose repeal of this tax rebate.”

They say the securities companies will leave the state.

“That’s bogus,” Rogers said. “Both Phil Steck and James Sanders have made it very clear that there is no way that the New York Stock Exchange or the big brokerage firms are going to leave New York simply because the state is no longer willing to rebate this tax that it collected for 75 years. That’s just a bogus argument. And it’s not going to affect workers’ pension funds.”

“This tax will affect the stock speculators. It’s not going to affect people involved in long term investments – like pension funds.”

“But the political leaders being bought off by these giant corporations are repeating this bogus line. The political leaders that oppose the repeal of this rebate need to be held accountable.”