Public Citizen last month called out the Justice Department for cutting yet another deferred prosecution agreement for the recidivist Swiss based technology company ABB.

“After a year of tough talk and speeches suggesting Attorney General Merrick Garland’s Justice Department would bring a bold new approach to fighting corporate crime, the recent ABB resolution of global foreign bribery charges is deeply disappointing,” Rick Claypool of Public Citizen told Corporate Crime Reporter.

“The case is a particularly worrisome example of a recidivist corporation being rewarded with a leniency agreement instead of facing actual prosecution. The previous criminal cases against ABB are dismissed as a decade old – failing to mention that the ABB misconduct in this new leniency agreement began, according to the government, within a year of its prior leniency agreement’s dismissal. So much for cracking down on corporate repeat offenders.”

Claypool said that ABB’s rap sheet now includes this latest FCPA case, two prior FCPA cases, and a bid rigging violation.

A year ago, Deputy Attorney General Lisa Monaco gave a speech claiming the Department has “no tolerance for companies that take advantage of pre-trial diversion by going on to continue to commit crimes,” calling such behavior “outrageous.”

“But the unmistakable message to corporate criminals is that, despite the tough talk, the Department actually has a great deal of tolerance for their illegal misconduct – and that little at the Department has changed during the transition from the Trump years, when corporate enforcement plunged, and the Biden years, when corporate enforcement plunged even further,” Claypool said.

ABB Ltd., was ordered to pay more than $315 million to resolve an investigation into violations of the Foreign Corrupt Practices Act (FCPA) stemming from the bribery of a high-ranking official at South Africa’s state-owned energy company.

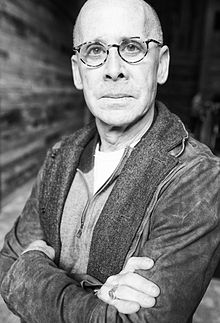

Paul Hastings partner Robert Luskin represented ABB in the case.

Luskin called the deferred prosecution agreement “exactly the right result.”

“If you are the Justice Department, you need to balance things like recidivism, that are not in the company’s control in the moment,” Luskin told Corporate Crime Reporter in an interview last month. “It’s who you are. It’s the baggage you drag behind you. You look at the things that are within the company’s control – which is a willingness to self-disclose, a willingness to fully remediate and cooperate fully.”

“The ABB resolution demonstrated the Department’s ability to balance those considerations and say – you are going to be treated more harshly if you have a record. The government required a plea, where absent its prior record, this would have been a straight deferred prosecution case. You can see the hand of Lisa Monaco’s statement in that aspect of the resolution.”

“I would point you toward Ken Polite’s statement in the press release where he said – we are trying to balance our desire to treat recidivists more harshly with our stated policy of trying to reward companies who identify wrongful conduct, bring it to the attention of the authorities, fully remediate and cooperate to an extraordinary degree – all of which ABB did.”

Luskin is steeped in anti-bribery law. With Dan Kahn, he teaches a course in anti-corruption at Georgetown Law Center. His practice is two-thirds FCPA cases, with the vast majority of his clients foreign corporations. He spends much of his time traveling overseas.

Why is so much of your practice representing foreign companies?

“Some of it is fortuitous,” Luskin said. “I’ve kind of been passed from hand to hand over there. And some of it is that I generally enjoy working for these companies. My experience with these foreign companies is that they tend to be a lot less hierarchical than comparably scaled American counterparts.”

“That means you spend lots of facetime with a general counsel. I will go over to Paris for a meeting and spend two or three hours in her office. And then there will be a couple of issues and she’ll say – let’s go talk to the CEO about those two things. And we walk.”

“That is a pleasing way to work. You have the opportunity to convey your advice to the highest levels of the company. And you have the opportunity to explain why it makes sense and why it is likely to get a decent result. It’s a congenial kind of working relationship.”

There were high expectations for the Biden Justice Department. And yet we haven’t seen a lot of corporate crime cases. In fact, corporate crime cases are down over the last couple of years. We hear – new administration, pipeline issues.

What’s your explanation?

“That would be mine,” Luskin says. ”These cases have a gestation period of two to four years. If we are seeing a downward trend now, that is something that happened between two and four years ago. The question was certainly asked of me all the time. Trump had said things not complimentary of the FCPA. And does that mean we are going to see diminished enforcement?”

“And my sense throughout that period of time was that they were full speed ahead and balls to the wall. And that the selection of cases and the way they were resolved were not driven at all by folks at the political level. I do perceive in this administration an effort toward hardening their effort toward corporate crime. But we are not going to see the product of that for a couple to three years.”

Are you noticing anything changing in terms of the number of big FCPA cases?

“I wouldn’t say that I do see a difference,” Luskin said. “There is always this focus on prosecution of individuals. The Yates memo codified something that was always there. It has been reasserted and reasserted and reasserted. And you still don’t see many of those individual cases. And that makes perfect sense to me. Those are much harder cases to put together. The government often lacks jurisdiction over the individuals. And the cases are much more likely to go to trial, which means you need a higher degree of preparation than you do for corporations. But beyond that, I don’t see them skewing one way or another.”

Given all of the FCPA investigations and prosecutions, is it actually deterring foreign bribery? Is there less foreign bribery than there was?

“I believe that to be the case. I kind of believe that the one two punch of increased enforcement, both in the United States and around the world, with the fact that as a result of that defense counsel are speaking to increasingly sophisticated chief compliance officers and C-suite level corporate executives who understand the importance of being compliant. I think that companies are behaving much better than they were fifteen years ago.”

“Twenty years ago, in France, not only was it not illegal to engage in foreign bribery, but you could show the tax authorities your foreign bribe and you could get a tax deduction. We have moved light years away from that.”

What about U.S. companies?

“U.S. companies are behaving much better,” Luskin says. “The interesting thing is that fifteen years ago, U.S. companies were complaining about the fact that the Europeans were continuing to bribe and that put them at a competitive disadvantage. And now, the Americans and the Europeans are complaining about the Chinese. But they are trying to conform their behavior at a very high level. That is something that I could never quantify and never prove, but absolutely believe to my core.”

[For the complete Interview with Robert Luskin, see 37 Corporate Crime Reporter 1(12), January 2, 2023, print edition only.]